The Ethereum blockchain is responsible for the majority of USDT and USDC transactions

Stablecoins continue to gain their place in the crypto market, showing high transaction volumes even in times of financial crisis. The Ethereum network is still one of the leading platforms for digital asset transactions, and USDC and USDT cryptocurrencies dominate the stablecoin market. Here we will discuss the latest data on what is happening now with their volumes, usage patterns, and impact on the world financial system.

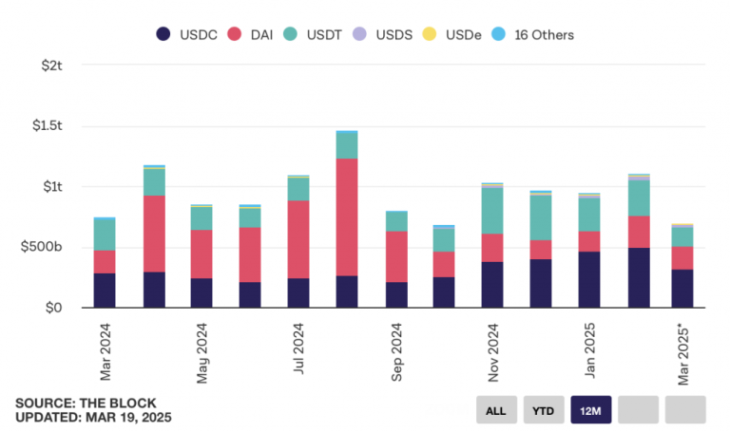

The stablecoin ecosystem on the Ethereum network shows high resilience and demand from market participants, especially during periods of increased volatility in speculative assets. Stablecoin transaction volume has remained steady at around $800 billion per month for the past four months. The active crypto addresses trading with stablecoins also keep increasing, crossing the 600,000 address mark in a week.

The most popular leaders of this segment of the crypto market are still USDC and USDT, which in February 2025 accounted for $740 billion out of the total volume of $850 billion (i.e. at least 87%). This is in itself proof of the preference of market operators for utilizing well-tried and trusted stablecoins.

Ethereum still dominates this year as the leading platform for stablecoin swaps at $35 billion in USDC and $67 billion in USDT. This also reflects the critical role Ethereum plays in being the middle layer of settlement of digital dollars-based transactions amidst competing blockchains.

There are a number of important advantages that digital stablecoins possess over conventional financial assets, such as 24-hour settlement, minimal fees for cross-border transfers, the potential for programmable money using smart contracts, and access for unbanked individuals.

Regulatory definition in the stablecoin space is also on the increase, as the US government was able to push through a bill on stablecoins aimed at creating definitive guidelines for stablecoin issuers. This can potentially legitimize large US stablecoin issuers such as Circle (USDC), Paxos (USDP), and PayPal (PYUSD).

The high turnover volumes of the stablecoins, not even declining amid times of market fluctuation, indicate that the utilitarian application of blockchain technology continues to be of increasing importance, fulfilling real economic needs of global users.

According to a report by Artemis and Dune, through February 2025, the supply of stablecoins in the market has risen by 63% over the past 12 months, and monthly transaction volumes have doubled with a 115% rise. The annual transaction volume of stablecoins has already reached an incredible 35 trillion US dollars.

The above statistics reflect the growing place of stablecoins in the global financial landscape as well as their immense potential for further growth in the use of stable digital tokens in other spheres of the economy.